Advertisement|Remove ads.

Can Poonawalla Fincorp Rally Till ₹500? SEBI RA Bullish After Expansion Plans, CEO Overhaul

Poonawalla Fincorp is drawing attention following a series of developments aimed at accelerating its growth in India’s non-banking financial sector.

SEBI-registered analyst Srinivasa Reddy noted the company’s expansion into Tier 2 and Tier 3 cities, with plans to add 400 branches over the next year.

The expansion is also expected to fuel loan book growth and boost customer reach.

This move aligns with its broader goal of becoming one of the top five NBFCs in the country by assets.

Leadership at the top has also undergone significant changes. Arvind Kapil, a veteran in financial services, has stepped in as Chief Executive Officer.

Reddy noted Kapil will concentrate on expanding digital and making operations more lean as the company moves to the next stage.

Meanwhile, the company’s promoter entity, Rising Sun Holdings, boosted its investment in the company by 0.5% last week, signaling long-term conviction in the business.

Reddy has projected an upside target of ₹475–₹500 over the coming two months. To manage risk, he suggested placing a stop-loss at ₹405.

On Wednesday, Poonawalla Fincorp disclosed the allotment of non-convertible debentures (NCDs) worth ₹808 crore through private placement.

The issuance includes ₹800 crore in fully paid secured NCDs under Series ‘C3’ and ₹8 crore in partly-paid NCDs under Series ‘C4’.

Both tranches carry a coupon rate of 7.7% per annum and have tenures of 5 years and 5 years 182 days, respectively.

The instruments will be listed on the BSE’s debt market segment and are secured by a first-ranking pari passu charge on hypothecated assets.

The company has committed to a 2% penalty over the coupon rate for any delay in interest or principal payments.

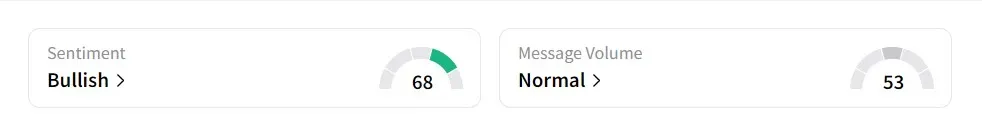

On Stocktwits, retail sentiment was ‘bullish’ amid ‘normal’ message volume.

The stock has risen 44.8% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_neww_a4e4f5f75e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Sourasis_Bose_Author_Image_939f0c5061.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_psychedelics_brain_resized_b52324b5d5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1496337898_jpg_8e75bdf43f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243968069_jpg_3ccb34d8bd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elon_musk_jpg_bfd8288cf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_unh_stock_resized_jpg_e69fd915e3.webp)